Toughing it out

Amid all the talk of a PC market slump and sovereign debt-fuelled global financial meltdown, tech companies continue to deliver better-than-expected quarterly earnings.

Microsoft is definitely viewed as a bellwether of the PC market, as it derives so much revenue from the sale of Windows licenses on new PCs. But it still managed record revenue for the June quarter of $17.37 billion, yielding $5.87 billion profit, which were eight percent and 30 percent up on the same period a year ago.

"Throughout fiscal 2011, we delivered to market a strong lineup of products and services which translated into double-digit revenue growth, and operating margin expansion," said Peter Klein, CFO at Microsoft. "Our platform and cloud investments position us for long-term growth."

Microsoft is a very un-sexy company these days, both among the tech press and investors, with its shares barely budging on the news. But it's quietly doing a good job of diversifying away from its cash-cows of Windows and Office.

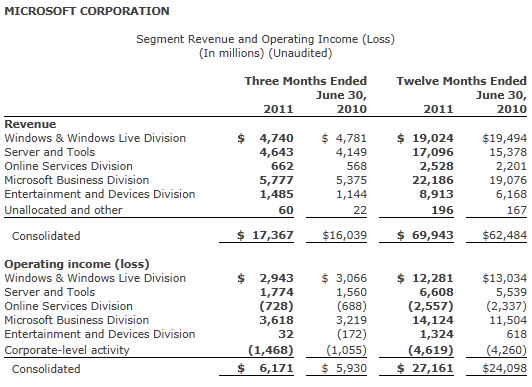

As you can see in the table below, the majority of revenue still comes from Windows and Business, but the main growth came from servers, online services and the Entertainment division - which includes Xbox and Windows Phone. Business Insider also offers a good summary of the various ways in which Microsoft is able to extract revenue from business.

AMD's results were more or less in line with expectations, but such is the perceived fragility of the company that merely not disappointing has been enough to drive its shares up by five percent in pre-market trading. It's always a pleasant surprise to see AMD make a profit, and revenues of $1.57 billion yielded net income of $61 million.

"In the first half of 2011, AMD brought to market the most competitive client offerings in our history, reinforcing our position as a design and innovation powerhouse," said Thomas Seifert, CFO and Interim CEO. "Today's computing experience is increasingly being defined by the ability to deliver brilliant multimedia and video content with all day battery life. Fusion APUs are ideal to meet this need, positioning AMD to gain unit market share in the mobile computing space."

The fact that AMD still has an interim CEO in place is the biggest cause for concern to AMD-watchers, since it's now more than half a year since it dumped the old one. The standard line about finding the right person was trotted out by general counsel Harry Wolin.

"The search for a new CEO remains a top priority," he said. "The board is pleased with the quality of the candidates interviewed and is confident in its robust and active process. They continue making progress to ensure a person is selected with the right vision, experience and track record to lead AMD into the future and to create increased shareholder value.

"The board is pleased that the senior management team has executed well throughout this timeframe. I would like to take this opportunity to emphasize that meeting a time line is not the driving force for the search: finding the right candidate is."

There's still mid-term concern about AMD's product offering, however. While the Fusion APU line seems to deliver, technologically, we've heard concerns about supply within the channel. On top of that, with Apple's iPad sales so big, there's speculation that the low and mid-range notebook markets - which are the main targets for Fusion - could get extensively eroded by tablets.