Profit prophet

Online local discount coupon service Groupon has filed for its initial public offering, from which it's aiming to raise $750 million, which could value the company in excess of $15 billion.

It's now inevitable that every IPO is linked to the supposed ‘social media bubble' or ‘bubble 2.0' or whatever other clever name is attached to the investment interest in social media companies. Since LinkedIn's first day pop, the talk of bubbles has increased, and some of the figures revealed in the IPO filing indicate solid profitability may still be a way away.

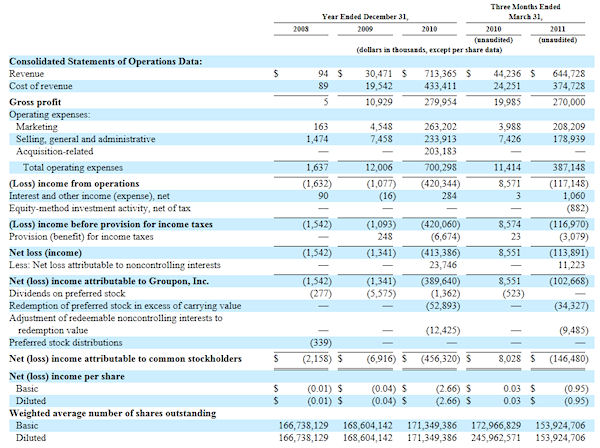

Groupon's revenues have grown at an amazing rate - from almost a standing start revenues grew from $30 million in 2009 to $713 million last year.

Furthermore we seem to be right in the middle of the exponential growth phase - revenues were $645 million in the first quarter of this year alone. Here's the table from the filing, and Business Insider has published a good summary of other key figures.

The thing is, the cost of acquiring this revenue is greater than the revenue itself - otherwise known as an operating loss. A big part of these costs was marketing, which Groupon seems to want to discount to some extent. There has also been a lot of money paid back to early stage investors.

There's clearly a big appetite for social media IPOs, and Groupon's revenue growth will make it very appealing. In that sense, if there is a bubble it's not like the dotcom one as companies being invested in are actually making money. However there's still a leap of faith required in valuing a company that has yet to make a profit in the tens of billions.