Good but not great

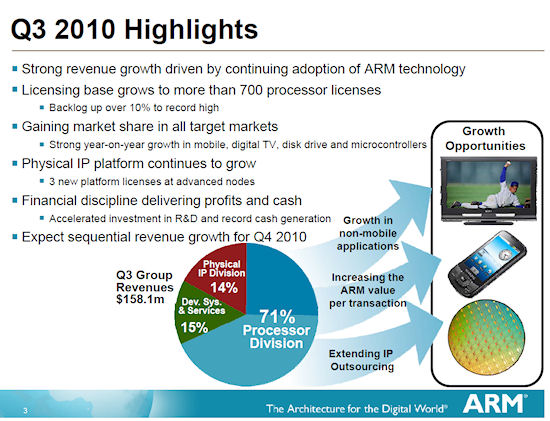

UK low-power chip designer ARM reported a 60 percent year-on-year rise in Q3 profit, which was slightly ahead of expectations, but its shares still fell by around five percent after the results were announced.

The reason for this is presumably that investors were hoping ARM would beat expectations by an even greater margin. The booming mobile Internet market - especially as embodied by Apple - may have led investors to assume ARM's fortunes would mirror Apple's.

"Q3 was a good quarter for ARM. Not only are we benefiting from growth in applications where we are the established market leader, including in smartphones and mobile computers, but we are gaining share in markets like digital TV and microcontrollers," said CEO Warren East.

"Our partners are also starting to develop chips in new markets for ARM, such as servers and laptops, creating longer-term opportunities. In addition, both physical IP and Mali graphics performed well with important license wins and increasing royalty revenues."

|

Q3 2010 - Financial Summary

|

Normalised* |

IFRS |

||||

|

Q3 2010 |

Q3 2009 |

% Change |

|

Q3 2010 |

Q3 2009 |

|

|

Revenue ($m) † |

158.1 |

123.0 |

29% |

|

158.1 |

123.0 |

|

Revenue (£m) † |

100.4 |

75.2 |

34% |

|

100.4 |

75.2 |

|

Operating margin |

37.7% |

31.7% |

|

|

18.6% |

9.6% |

|

Profit before tax (£m) |

38.8 |

24.3 |

60% |

|

19.6 |

7.7 |

|

Earnings per share (pence) |

2.08 |

1.34 |

55% |

|

1.09 |

0.53 |

|

Net cash generation** |

65.0 |

28.3 |

|

|

|

|

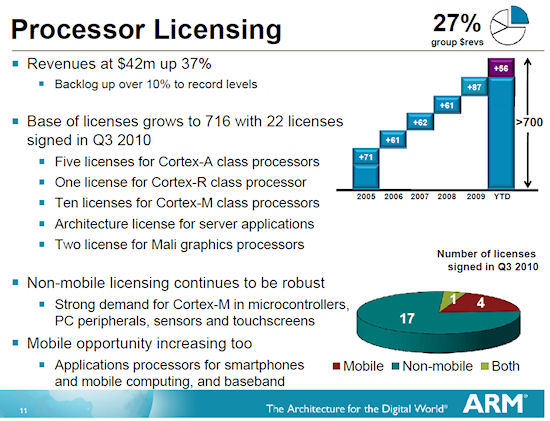

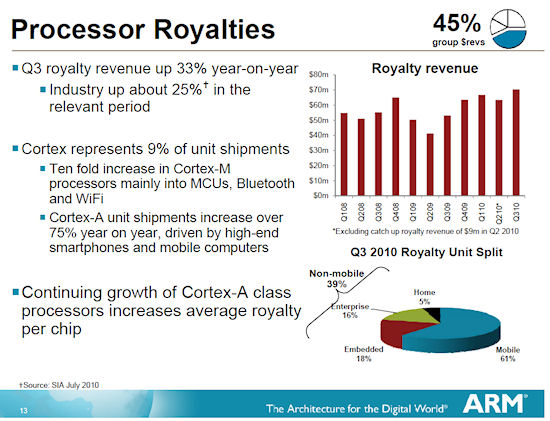

There was a bunch of data chucked around, but we feel a key statistic to ARM increasing its profitability is Cortex A sales. This is the ‘sexy' end of the market as they are ARM's most powerful processor designs, and as a consequence ARM charges more in terms of both licensing fees and royalties when these designs are used in an SoC.

Of the 22 new licenses sold in Q3, five were Cortex A. East stressed that a growth driver for ARM is not just higher-end designs, but the increasing number of ARM designs found in every device - especially phones. Here's a breakdown of the ARM IP contained in device shipments over the quarter.

Q3 2010 Processor Unit Shipment Analysis

|

Processor Family |

Unit Shipments |

|

ARM7 |

49% |

|

ARM9 |

33% |

|

ARM11 |

9% |

|

Cortex |

9% |

We've also included some slides from ARM's earnings presentation below. It's interesting to see that, while the vast majority of new licenses were outside the mobile sector, the majority of the royalty unit split was in favour of mobile. Note how much greater a proportion of ARM's revenues are accounted for by royalties (incremental) than licenses (one-off).